WASHINGTON — The infrastructure bill that President Biden hopes to get through Congress is supposed to create jobs and spur projects for companies like Anchor Construction, which specializes in repairing aging bridges and roadways in the nation’s capital.

But with baby boomers aging out of the work force and not enough young people to replace them, John M. Irvine, a senior vice president at Anchor, worries there will not be enough workers to hire for all those new projects.

One estimate says Biden’s infrastructure bill would add $1.4 trillion to the U.S. economy over eight years, but without enough workers, efforts to strengthen roads and public transit could be set back.

“I’d be surprised if there’s any firm out there saying they’re ready for this,” said Mr. Irvine, whose company is hiring about a dozen skilled laborers, pipe layers and concrete finishers. If the bill passes Congress, he said, the company will most likely have to double the amount it is hiring.

“We will have to staff up,” Mr. Irvine said. “And no, there are not enough skilled workers to fill these jobs.”

Mr. Biden has hailed the $1 trillion infrastructure bill as a way to create millions of jobs, but as the country faces a dire shortage of skilled workers, researchers and economists say companies may find it difficult to fill all of those positions.

The bill could generate new jobs in industries critical to keeping the nation’s public works systems running, such as construction, transportation and energy. S&P Global Ratings estimated that the bill would lift productivity and economic growth, adding $1.4 trillion to the U.S. economy over eight years. But if there is not enough labor to keep up with the demand, efforts to strengthen the nation’s highways, bridges and public transit could be set back.

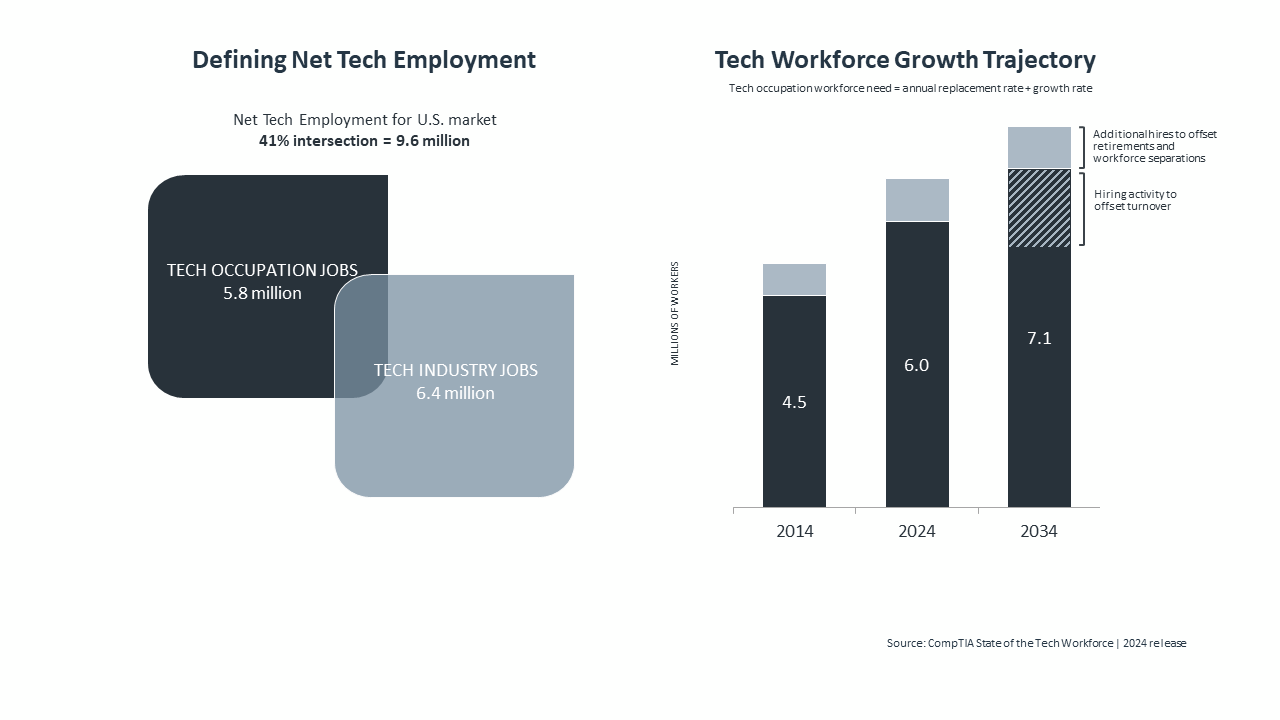

U.S. TECHNOLOGY WORKFORCE TODAY

The tech workforce consists of two primary components, represented as a single figure by the ‘net tech employment’ designation. The foundation is the set of technology professionals working in technical positions, such as IT support, network engineering, software development, data scientist, and related roles. Many of these professionals work for technology companies (45%), but many others are employed by organizations across every industry sector in the U.S. economy (55%).

The second component consists of the business professionals employed by technology companies. These professionals – encompassing sales, marketing, finance, HR, operations and management, play an important role in supporting the development and delivery of the technology products and services used throughout the economy.

According to projections from the U.S. Bureau of Labor Statistics and Lightcast, in the next ten years the tech workforce will grow twice as fast as the overall U.S. workforce. The replacement rate for tech occupations during the 2024-2034 period is expected to average about 6% annually, or approximately 350,000 workers each year, totaling several million through 2034.

According to projections from the U.S. Bureau of Labor Statistics and Lightcast, in the next ten years the tech workforce will grow twice as fast as the overall U.S. workforce. The replacement rate for tech occupations during the 2024-2034 period is expected to average about 6% annually, or approximately 350,000 workers each year, totaling several million through 2034.

Tech occupation employment over the next 10 years is expected to grow at about twice the rate (2x) of overall employment across the economy. This confirms the relative strength of tech employment compared to many other occupation categories as companies of all sizes across every sector industry sector of the economy pursue digital transformation (DX) initiatives.

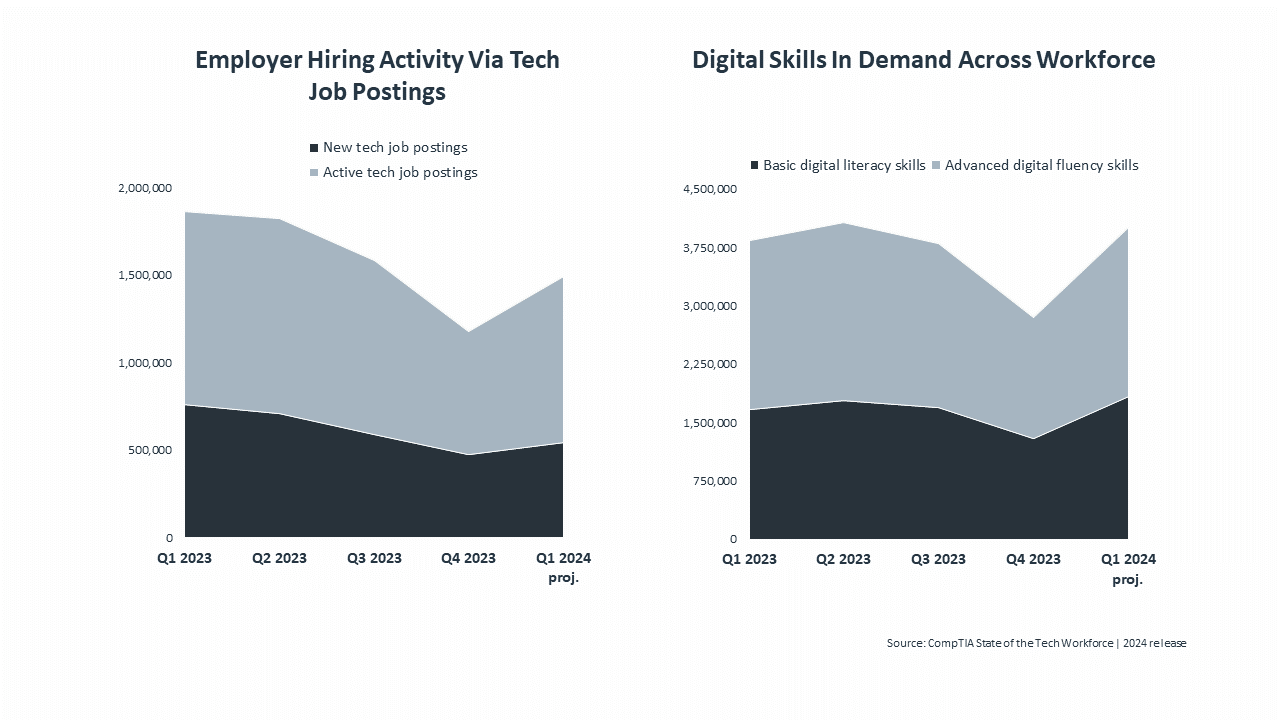

Employer job posting data provides another layer of near real-time insight into the tech job market and how companies are navigating talent needs due to growth, as well as backfilling for retirements or separations.

Employer job posting data provides another layer of near real-time insight into the tech job market and how companies are navigating talent needs due to growth, as well as backfilling for retirements or separations.

Job posting analysis trending reveals a dip following the hiring frenzy of 2022 before settling into a more normal range. Early Q1 2024 data indicates an uptick as employers re-evaluate hiring plans put on hold and eyeing growth investments requiring new skills and tech talent.

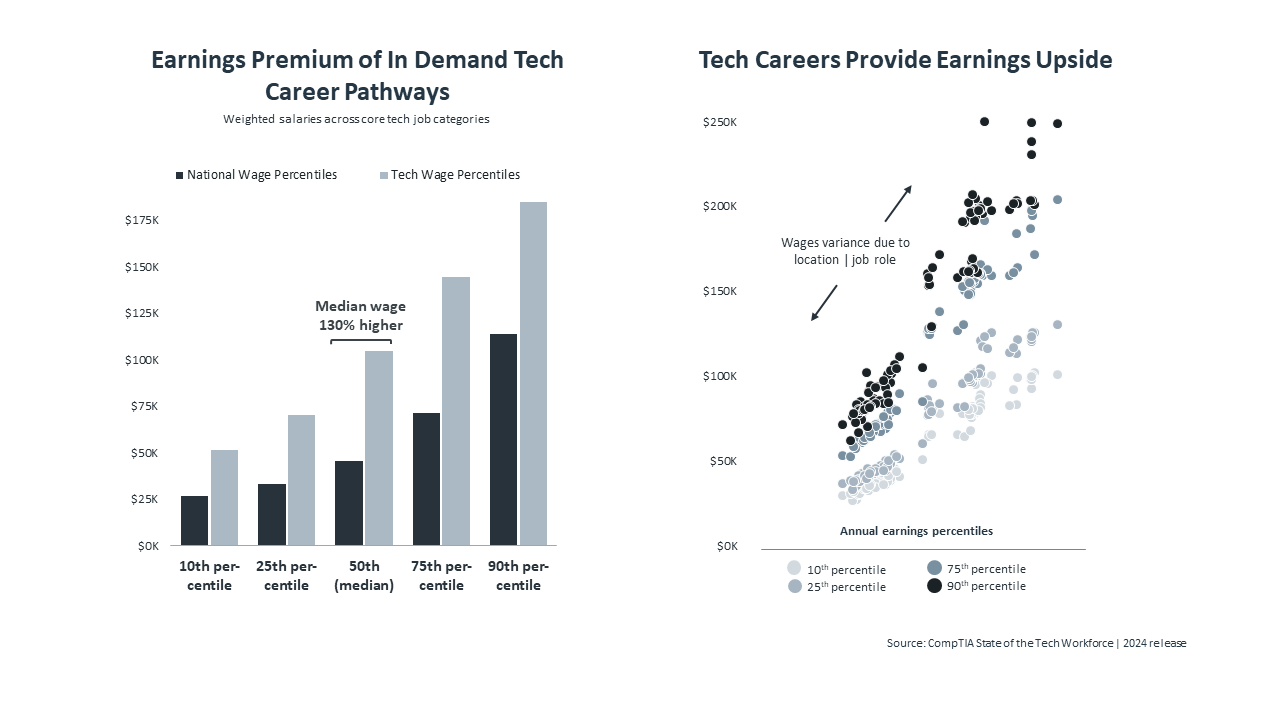

Across all tech occupation categories covered in this report, the median salary, also referred to as the 50th percentile or midpoint, was an estimated $104,556 for the most recent year of available data. This figure is more than double the median wage across all occupations of the U.S. labor force reflecting the premium in earnings associated with in demand tech job roles.

Across all tech occupation categories covered in this report, the median salary, also referred to as the 50th percentile or midpoint, was an estimated $104,556 for the most recent year of available data. This figure is more than double the median wage across all occupations of the U.S. labor force reflecting the premium in earnings associated with in demand tech job roles.

Percentiles help to provide insight into how salaries progress throughout a tech career, with the upper levels at the 75th or 90th percentile range achieved through years of experience, training and certifications. Of course, there are many nuances with salary data due to cost of living (COL) factors across regions. Please see full report for a deeper dive into tech workforce earnings.

Read more about IT Workforce.

“Do we have the work force ready right now to take care of this? Absolutely not,” said Beverly Scott, the vice chair of the President’s National Infrastructure Advisory Council.

A recent U.S. Chamber of Commerce survey found that 88 percent of commercial construction contractors reported moderate-to-high levels of difficulty finding skilled workers, and more than a third had to turn down work because of labor deficiencies. The industry could face a shortage of at least two million workers through 2025, according to an estimate from Construction Industry Resources, a data firm in Kentucky.

The pandemic has compounded labor shortages, as sectors like construction see a boom in home projects with more people teleworking and moving to the suburbs. Contractors have also faced a scarcity of supplies as prices soared for products like lumber and steel.

Job openings in construction have picked up at a rapid clip after the sector lost more than one million jobs at the beginning of the pandemic. According to an Associated Builders and Contractors analysis, construction job openings have increased by 12 percent from pre-pandemic levels. But the sector is still down about 232,000 jobs from February 2020, according to data from the Bureau of Labor Statistics.

The issue underscores a perennial challenge for the skilled trades. Not enough young people are entering the sectors, a concern for companies as older workers retire from construction, carpentry and plumbing jobs. And although many skilled trade positions have competitive wages and lower educational barriers to entry, newer generations tend to see a four-year college degree as the default path to success.

Infrastructure workers tend to be older than average, raising concerns about workers retiring and leaving behind difficult-to-fill positions. The median age of construction and building inspectors, for instance, is 53, compared with 42.5 for all workers nationwide. Only 10 percent of infrastructure workers are under 25, while 13 percent of all U.S. workers are in that age group, according to a Brookings Institution analysis.

“The challenge is, how are we going to replace — not just grow, but replace — many of the workers who are retiring or leaving jobs?” said Joseph W. Kane, a fellow at the Brookings Institution. “A lot of people, especially younger people, just aren’t even aware that these jobs exist.”

Community colleges, which offer a variety of vocational training programs, have suffered steep declines in enrollment. A recent estimate from the National Student Clearinghouse Research Center found that community colleges were the hardest hit among all colleges, with enrollment declining by 9.5 percent this spring. More than 65 percent of the total undergraduate enrollment losses this spring occurred at community colleges, according to the report.

Credit…Alyssa Schukar for The New York Times

Nicholas Kadavy, a third-generation mason who owns Nebraska Masonry in Lincoln, Neb., has seen his workload triple since April. He said his company had already scheduled out work until June 2022.

He wants to hire more skilled masons to finish the projects sooner, but he can’t find enough people to fill the dozen positions he has open, even though he is willing to pay up to $50 an hour — twice what he offered before the pandemic. He checks his email daily, waiting for more applications to come in.

“My biggest struggle is finding guys that want to work,” Mr. Kadavy said.

Even when he does hear from applicants, Mr. Kadavy said, he is unable to hire many of them because they are not qualified enough. He was already seeing a shortage of skilled masons before the pandemic, he said, and he worries that the craft is “dying” because newer generations are not pursuing the field.

The nation’s public transit systems would receive $39 billion under the infrastructure bill, allowing agencies to expand service and upgrade decades-old infrastructure. But transit agencies are dealing with worker shortages of their own, facing a dearth of bus drivers, subway operators and maintenance technicians.

Metro Transit in Minneapolis is trying to hire about 100 bus drivers by the end of the year, said Brian Funk, the agency’s acting chief operating officer. The agency had originally aimed to hire 70 workers by the end of June, but it met only about half of that goal.

Although he is optimistic that the agency will be able to fill those remaining positions after ramping up efforts to promote the openings, he said he was still wary about some workers choosing to leave.

“We know that every day that goes by, there’s the potential that somebody else is looking at either retirement or another job,” Mr. Funk said.

Some are optimistic that policymakers will be able to scale up work force development programs to keep up with the demand the infrastructure bill would create. Projects could take several months to get started, economists said, giving the country time to train workers who are not yet qualified.

“These problems are not insurmountable,” said Nicole Smith, the chief economist at the Georgetown University Center on Education and the Workforce. “Not having a sufficiently trained work force is something that can be addressed.”

But others are worried that the bill does not do enough to draw more people into infrastructure fields, especially historically underrepresented groups like women and people of color. Although Mr. Biden originally proposed a $100 billion investment in work force development, that funding was left out in the latest version of the bipartisan infrastructure bill. The funding would have invested in job training for formerly incarcerated people and created millions of registered apprenticeships, among other things.

Last week, the National Skills Coalition and more than 500 other organizations sent a letter to congressional leadership calling on it to include the funding in a separate reconciliation bill.

“President Biden promised that economic recovery was going to be predicated on equity,” said Andy Van Kleunen, the chief executive of the National Skills Coalition. “Work force training has to be part of that answer.”